Real Estate Valuation Techniques

There are many factors that may influence the value of a property, such as location, condition, size, proximity to good schools, etc… The formal property valuation process takes into account all these factors to determine the market value of the property at a particular point in time. However, most of the time, property value and price differ. This is because, like any other market, the property market is an imperfect one where both buyers and sellers are not perfectly informed or even rational.

Broadly, there are five methods to ascertain the market value of a property:

– Direct Comparison Method

– Investment Method

– Cost Method

– Residual Method

– Profits Method

Direct Comparison Method

The direct comparison method involves comparing the property with recently transacted properties of similar or comparable attributes. For example, if your neighbour recently sold his apartment (which is a replica of yours) for $1 million, your apartment may be valued at $1 million. However, since no two apartments are the same or transacted in the same market condition, other factors will come into play. For instance, a cost per unit floor area (usually $psf) may be used to extrapolate the value of the property when the size of the comparable differs.

Investment Method

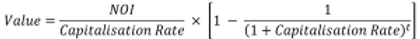

The investment method looks at the property from an investment point of view, whereby the property is seen as an income-generating asset. Broadly, there are two methods for measuring the value through this method. The first, is the Discounted Cash Flow (DCF) method, where the forecasted cash flows for the property are discounted back to the present value using a required rate of return. This works well for leasehold properties that have a finite holding period for the investment. For freehold properties (including 999 leases), we will need to estimate a terminal value for the property sometime in the foreseeable future (say 20 to 30 years’ time) to include it as the final cash flow component. Second, is the capitalisation method, where the net operating income from the property is divided by a capitalisation rate. The capitalisation rate is a market-derived risk factor, which for freehold properties (including 999 leases) is determined by dividing the net operating income by the transacted prices of comparable properties. For leasehold properties, we need to use a slightly more complicated formula shown below (where t is the remaining lease period):

Cost Method

The cost method looks at the costs involved in constructing a replacement property serving the same purpose in the same location. To do so, we simply add in the land value and construction costs, as well as a profit margin for the developer. This represents the cost involved should a current developer decide to construct the same property in the same area. For properties that have aged quite a bit, a depreciation expense should be included to reflect a more accurate value of the property at that point in time.

Residual Method

The residual method is commonly used for properties that are subjected to redevelopment. The developers are interested in the land value of the property instead of the value of the entire property which includes the building. To do so, we simply take the sale proceeds and remove the sales costs as well as development expenses (such as demolition costs) incurred to revert the land to its original state. From here, developers will then factor in their profit margin as well as other costs (such as legal fees, stamp duties, tax, etc…) to determine the value of the land. Now, knowing the land value as well as their own development cost, developers will be able to estimate how much they should purchase the property from the original owners.

Profits Method

The profits method is usually used for owner-occupied properties which are deployed as operating assets (such as hotels, hospitals, etc…). Since these properties form part of the owner’s core business, its valuation must take into consideration the operating performance of the business. For instance, hotel value is closely tied to how much profits it is making instead of the other methods listed above.

It is common for Valuers to use a combination of the methods listed above to derive the market value of the property. For savvy real estate investor, knowing how to value a piece of property can help them sieve out the hidden gems in the market.

Disclaimer: All analyses, recommendations, and other information herein are published for general information. Readers should not rely solely on the information published and should seek independent financial advice before making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.

Sign up to our newsletter

Sign up for our newsletter to stay in touch with global real estate news and opportunities!

By signing up, you acknowledge that you have read and agreed to our privacy policy.